Definitions:

Deductible: an amount paid up front by the Associate for any services rendered before the insurance begins to pay.Out of Pocket Maximum: The dollar amount set by the plan which puts a cap on the amount of money the Associate must pay out of his or her own pocket for covered expenses which includes the deductible.

Deductible and Out of Pocket Configuration

To view information on your medical benefits go to www.umr.com.You can utilize this site to check your benefits and see what’s covered, look up what you owe or how much you have paid, find doctors in your network, and more. With Grande’s medical plan you need to meet the deductible before any co-insurance will cover 80% of services using in-network providers and 60% of service for out of network providers.. This deductible does split out with the different dependents listed on the plan. Please see the family example below:

Example

Associate Jane carries insurance for herself, her husband John and their son Max

Jane:

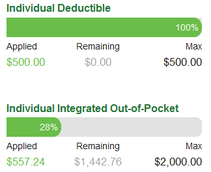

- This year, Jane sprained her ankle and had to go to the ER. Total cost to her was $501.90. In addition, she also was prescribed pain medication that she picked up from her pharmacy after the ER visit, costing $55.34

- $500 of the charges applied and met deductible. The remaining $1.90 of her patient cost was 20% co-insurance.

- $500 deductible + $1.09 coinsurance + $55.34 prescription = TOTAL Out of Pocket cost of $557.24

John:

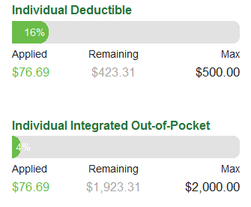

John visited a chiropractor once this year for some back and shoulder pain. Total cost of this one visit was $76.69.

- $76.69 applied towards his deductible and his out of pocket maximum

Max:

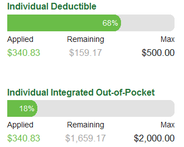

Max was not feeling well for a couple of days and Jane took him to urgent care. There, he received labs and an xray of his chest as he had a bad cough. This visit cost a total of $340.83.

$340.83 applied to deductible and out of pocket maximum

Conclusion:

Jane: Deductible applied: $500

John: Deductible applied: $76.69

Max: Deductible applied: $340.83

Total Family Deductible Met: $917.52 of $1,500

***Out of pocket cost includes deductible, co-insurance and prescription***

Jane: Out of pocket cost: $557.24

John: Out of pocket cost: $76.69

Max: Out of pocket cost: $340.83

- Once each participant reaches the $2,000.00 out of pocket maximum for the year, the plan will cover eligible charges at 100% for the remainder of the calendar year.

- Each January, the deductible and out of pocket maximum start over as this marks the beginning of the new benefit year. For any additional questions you can contact benefits@grande.com.